The global battery energy storage system (BESS) market experienced a surge in 2025, with total installations reaching approximately 315 GWh, a 51% increase from the previous year. China maintained its dominant position, followed by the United States, while Saudi Arabia, Australia, and Chile emerged as new top-tier markets. This growth, primarily driven by large-scale grid projects, has outpaced electric vehicle battery demand. Despite record-low pricing earlier in the year, a recent rally in lithium prices is beginning to impact cell costs and system negotiations heading into 2026.

According to the latest data from Benchmark Mineral Intelligence, the energy storage sector achieved a significant milestone in 2025 as the combined capacity of grid-scale and behind-the-meter systems surpassed 300 GWh. The market’s expansion was fueled by a dramatic increase in giga-scale projects, with 46 such facilities coming online compared to just 17 in 2024. This momentum is expected to accelerate, with forecasts suggesting that global operational capacity could exceed 450 GWh by 2026, supported by a robust pipeline of over 150 large-scale developments.

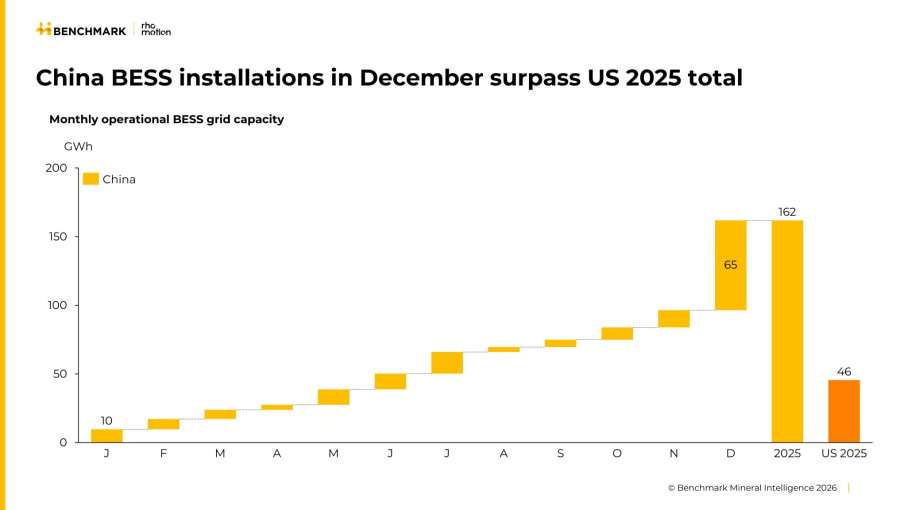

China continues to be the primary engine of growth, deploying more storage capacity in December alone than the United States managed throughout the entire year. The global landscape is also shifting, as Saudi Arabia, Australia, and Chile have ascended to the top five markets, displacing previous leaders like the United Kingdom and Italy. While grid-scale installations accounted for roughly 240 GWh of the total, the overall lithium-ion battery market saw a structural shift toward stationary storage, which grew at twice the rate of the electric vehicle sector.

The pricing environment for BESS hardware reached historic lows in 2025, with Chinese project tenders dipping to $63/kWh. However, the market is currently facing new headwinds. Lithium prices have hit a two-year peak due to tightening inventories and the removal of battery tax rebates in China. These rising costs have already triggered a 10% increase in the price of 314Ah lithium iron phosphate (LFP) cells. While higher margins in international markets may allow some developers to absorb these costs, industry experts anticipate that the lithium rally will play a central role in upcoming system price negotiations.

Technologically, LFP remains the preferred chemistry for stationary storage, with demand growing by 48% year-on-year. This trend is visible globally, as LFP’s market share outside of China has now climbed above 30%, while nickel-based chemistries have seen their share decline. Regional demand profiles vary significantly; while North America saw BESS rise to 26% of its total battery demand, Europe remains heavily focused on transportation, with electric vehicles accounting for 85% of its battery consumption.