Despite persistent claims that hydrogen is on a similar cost-reduction trajectory as solar panels and batteries, a detailed analysis reveals fundamental economic and technical barriers preventing such a trend. The total cost of hydrogen is dominated by the price of electricity, which accounts for up to 70% of the final figure. Unlike the simple, mass-produced nature of solar modules, hydrogen electrolyzers are complex, customized systems with significantly lower potential for cost reduction through manufacturing scale, ensuring hydrogen will likely remain a high-cost, niche solution for decarbonization.

The true expense of hydrogen production is captured by the Levelized Cost of Hydrogen (LCOH), a metric that includes capital equipment, operational expenses, electricity, and distribution. Electricity remains the single largest component, meaning that even a dramatic drop in the cost of electrolyzer hardware would have only a marginal impact on the price per kilogram. This creates a difficult trade-off: running an electrolyzer only during periods of cheap renewable energy results in low utilization, which drives up the capital cost per unit of hydrogen produced. Conversely, continuous operation requires purchasing power when prices are high, which also inflates the final cost.

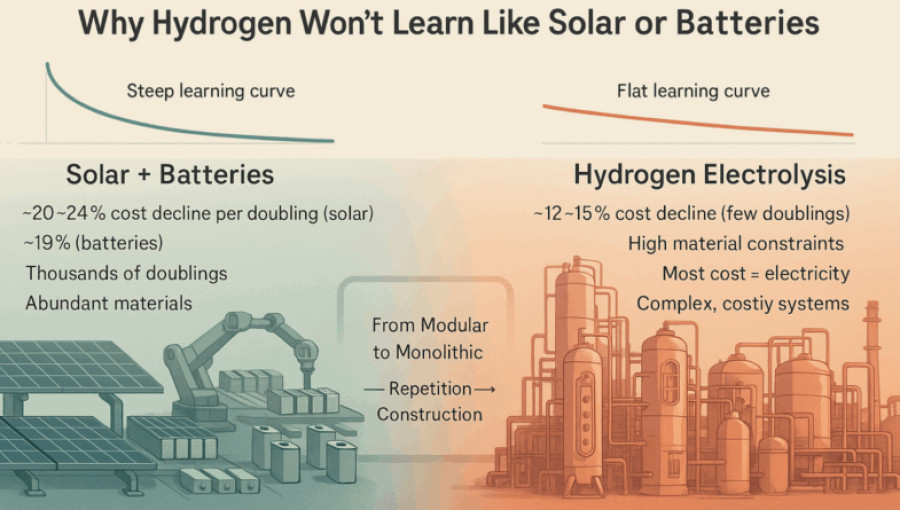

The frequent comparison of electrolyzers to solar panels and batteries is misleading. Solar modules and battery cells are highly modular products manufactured in automated factories by the millions, allowing them to benefit from steep cost declines with each doubling of production, a principle known as Wright’s Law. These technologies have seen cost reductions of 19-24% per doubling. Electrolyzers, however, are complex integrated systems involving chemical, mechanical, and thermal components. They are built in much smaller volumes, often with site-specific customizations, resulting in a much slower learning rate of only 10-15% per doubling.

Material constraints and engineering complexity further inhibit cost reductions. Proton-exchange membrane (PEM) electrolyzers, a leading technology, depend on the extremely rare and expensive catalyst iridium. While alternatives exist, they come with their own limitations. Alkaline electrolyzers avoid precious metals but cannot ramp up and down quickly to match variable renewable energy output, while solid oxide systems remain in early-stage development. Consequently, major organizations like the IEA and BNEF have begun revising their hydrogen cost forecasts upward, acknowledging that factors like material inflation and financing costs have offset manufacturing gains.

Beyond production, the costs associated with transporting and storing hydrogen gas present another significant hurdle. Unlike electricity, which moves through wires, or batteries, which can be easily shipped, hydrogen must be compressed, liquefied, or chemically converted for transport. These processes are energy-intensive and expensive, with U.S. Department of Energy data showing that delivery and dispensing alone can add $8–$11 per kilogram to the final price, effectively doubling the cost.

Alternative forms of hydrogen offer little economic relief. “Blue hydrogen,” produced from natural gas with carbon capture, inherently adds cost and complexity to the already mature process of creating “gray” hydrogen, making it more expensive. Meanwhile, emerging concepts like “white hydrogen” from natural geological deposits or subsurface generation face their own immense challenges in extraction, purification, and transport, limiting their potential to highly localized industrial applications. Ultimately, the high costs across its value chain suggest hydrogen will be a valuable tool in specific hard-to-abate sectors, not the universal clean fuel some have envisioned.