European leaders and technology experts are issuing a stark warning: Europe has a narrow, two-year window to establish a leading role in perovskite solar technology or risk repeating the past failure of ceding the entire silicon solar panel industry to Asia. At a recent industry event, key figures stressed that while perovskite offers a revolutionary opportunity for energy generation on virtually any surface, competitors like China and India are moving quickly. The consensus is that Europe must act decisively to build a new industrial base focused on this promising, lightweight, and low-carbon solar film technology.

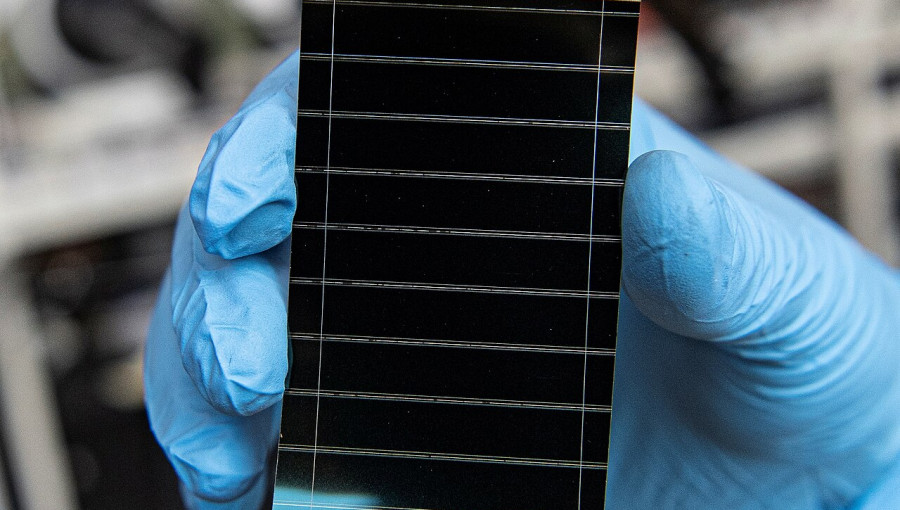

A decade after Europe’s silicon solar panel manufacturing sector was effectively lost to China, which now controls over 80% of global production, the continent stands at a similar crossroads with perovskite. This emerging technology involves ultra-thin, flexible solar films that are cheaper to produce and have a significantly lower CO2 emission footprint than their silicon counterparts. The material’s versatility could transform surfaces from building facades and vehicle bodies to noise barriers into energy-producing assets. The central question debated by experts, policymakers, and industry leaders at the Solar Flexible event is whether Europe will seize this chance to innovate and manufacture, or once again become dependent on Asia for a critical energy technology.

Tjark Tjin-A-Tsoi, CEO of the research organization TNO, compared the need for industrial self-sufficiency in solar technology to that of national defense. “We have made ourselves far too dependent on all fronts,” he stated, urging a return to manufacturing in Europe. He emphasized the urgency, noting, “Perovskite has extremely interesting properties. China and India know this too — they are working just as hard on it. Time is running out.” His sentiment was that the next two years will be decisive in determining the global leader in this field.

To overcome Europe’s high labor and energy costs, experts propose a strategy centered on advanced automation. TNO researcher Sjoerd Veenstra suggested focusing on “mass customization,” where smart, automated assembly lines can efficiently produce solar modules tailored for specific buildings or surfaces. He noted that the production of perovskite is relatively low in energy consumption, which could mitigate one of Europe’s competitive disadvantages. This approach could help the Netherlands meet its ambitious solar energy target of 200 GWp by 2050, which will require covering an estimated 1,250 square kilometers with solar panels, ideally by integrating them into existing structures.

However, some industry voices advise a more targeted approach. Bas van Kreeke, CEO of SolTech Energy, argued that perovskite should not be seen as an immediate replacement for silicon, which remains the standard for buildings due to its proven track record and certifications. He, along with prominent solar energy figure Wim Sinke, suggested that Europe should initially focus on niche applications where silicon technology falls short. An example is agrivoltaic projects, where perovskite films could be designed to selectively filter light, simultaneously generating power and accelerating the growth of specific crops below. This strategy would allow the technology to mature and prove its reliability in specialized markets.

While the discussion points to a clear path forward, the technology remains in an experimental phase. At the Brainport Industries Campus, TNO demonstrated a new Mass Customization Line for flexible solar films, a significant step in research and development. However, officials confirmed the pilot line still uses silicon, highlighting that reliable, large-scale perovskite production is not yet a reality. The consensus is that Europe possesses the highly educated workforce and innovative capacity, but it must now rediscover the “eagerness” and “hunger” to rapidly scale up production and secure its own energy future.