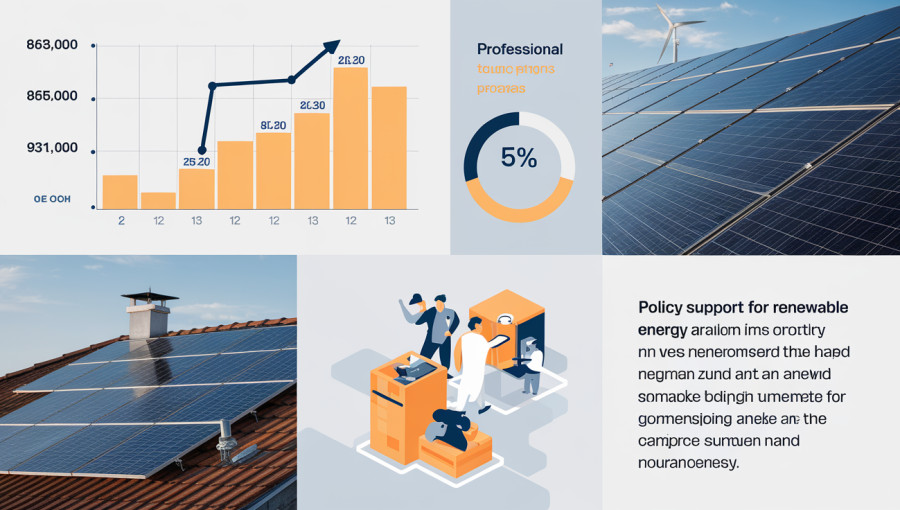

A recent report from SolarPower Europe reveals that the solar job market in the European Union reached an estimated 865,000 full-time equivalent positions in 2024, representing a 5% increase as installations soared to a record 65.1 GW. However, this positive trend is expected to reverse in 2025, with job numbers projected to fall to 825,000 as the residential rooftop market declines. Despite challenges, there is potential for a rebound in employment, which could rise to 916,000 by 2029 and possibly hit the million-job mark after 2030, contingent upon the implementation of supportive policies.

The growth of the solar industry has notably slowed following the energy price spikes of 2022 and 2023, with 2024 seeing an addition of capacity that hit a new high, although the annual growth rate fell to 3.3%. Within the solar job landscape, approximately 44% of roles were direct jobs, while 56% were indirect. A significant majority, around 86%, were related to deployment, highlighting the sector’s local economic impact and sensitivity to installation rates. Meanwhile, operations and maintenance accounted for 8% of the workforce, manufacturing contributed around 5%, and decommissioning and recycling made up roughly 2%.

Germany remains the leading employer in the solar sector, with about 128,000 jobs, followed closely by Spain with approximately 122,000 and Italy surpassing 100,000. Other countries in the top seven include Poland, France, Romania, and Hungary. As the market shifts towards larger utility-scale projects, the proportion of jobs linked to rooftop installations has decreased from 68% in 2023 to 59% in 2024. This shift reflects regional variations in project capital expenditures, which significantly influence labor demands per megawatt.

Looking ahead to 2025, forecasts suggest an employment decline to around 825,000 jobs if there is a minor dip in installations. Projections indicate recovery by 2029, with job totals potentially reaching 916,000 under a central scenario, or exceeding 1.1 million in an optimistic forecast, while a bleak scenario could see numbers plummet to around 675,000 due to subdued deployment and factory closures. Achieving the aspirational target of a million solar jobs now seems feasible only post-2030.

Manufacturing, however, continues to represent a significant weakness within the sector. In 2024, low factory utilization and continued shutdowns were prominent challenges exacerbated by excessive global capacity and competitive pricing pressures. The sector primarily relies on inverters and polysilicon, while the employment numbers in cells, modules, ingots, and wafers remain limited. Expectations for manufacturing jobs point to a potential rise to around 45,000 by 2029 under a central scenario, influenced by the success of a few advanced projects, but could drop to as low as 14,000 in a prolonged market decline.

Conversely, the operations and maintenance sector is anticipated to experience steady growth due to the increasing number of installed systems, with jobs expected to rise from about 66,000 in 2024 to around 109,000 by 2029. Despite advancements in efficiency and the adoption of digital tools, the demand for maintenance jobs remains robust. Meanwhile, the decommissioning and recycling sector, currently small, may see rapid expansion, projecting growth from around 14,000 jobs to approximately 27,000 by 2029 in a central scenario, as more systems reach the end of their operational life.

The report attributes the near-term slowdown in the industry primarily to weaker demand for rooftop installations, as inverter prices stabilize and government incentives diminish. It emphasizes the need for a stable policy environment, swift reforms in grid management and permitting processes, and sufficient flexibility resources to protect employment and ensure steady installation rates.

A significant challenge persists in the form of ongoing skills shortages in the sector. Companies cite difficulties in attracting skilled workers such as electricians, roofers, engineers, and manufacturing experts, coupled with tight training budgets. The study suggests developing a clear skills strategy to align with Europe’s energy objectives, proposing initiatives such as a Solar Skills Intelligence and Mapping Hub, improved accessible training funding for SMEs, and robust vocational training pathways with inclusive targets, amongst others.

In its methodology, the report employs employment metrics combined with capital and operational expenditures modeling, alongside EU input-output multipliers to identify both direct and indirect job effects. By integrating updated manufacturing utilization assumptions and revised end-of-life projections from the EVERPV Horizon project, it offers a comprehensive view of the transitioning solar sector in Europe. While deployment may cool in 2025, the prospect of targeted policy measures and strategic skills initiatives could pave the way for sustainable growth in the sector as the decade progresses.