Solar Materials is preparing for a massive surge in decommissioned solar panels by scaling its automated recycling capacity to 35,000 tons annually by 2026. As European solar waste is projected to increase 20-fold by the end of the decade, the German company is positioning itself to recover high-value materials like silver and silicon. By transitioning from its current 7,000-ton capacity to industrial-scale operations, Solar Materials aims to strengthen the circular economy while reducing dependence on raw material imports and cutting CO2 emissions by up to 80% compared to primary production.

Speaking at the TaiyangNews Solar & Sustainability conference 2025, Janett Schmelzer, Head of R&D at Solar Materials, highlighted that the industry is on the verge of its first major wave of end-of-life solar modules. With early utility-scale and residential installations reaching the end of their functional lifespans, the volume of waste is expected to skyrocket. This shift presents a significant material opportunity; the silver and silicon contained within these modules possess a market value reaching into the billions of euros. Recovering these strategic resources at scale is becoming essential for Europe’s industrial autonomy.

Founded in Magdeburg in 2021, Solar Materials currently operates what is considered the most advanced recycling facility for crystalline silicon modules in Europe. The plant processes a variety of waste, including modules damaged by extreme weather, components from repowering projects, and manufacturing rejects. While the logistics of handling heavy, glass-heavy pallets remain a challenge, the company is focusing on the 10-15 year lag between manufacturing peaks and recycling needs to stay ahead of the coming demand.

The material composition of a typical solar module presents a unique economic puzzle. While glass and aluminum make up roughly 65% of the total weight and are relatively simple to process, they do not hold the highest value. Conversely, silver accounts for less than 0.5% of a module’s weight but represents over 45% of its total material value. Silicon is also a priority, though its purity is often compromised during standard recycling. Solar Materials is working toward achieving a “6N” purity level of 99.9999% for recovered silicon, which would allow the material to be used directly in the production of a new solar cell.

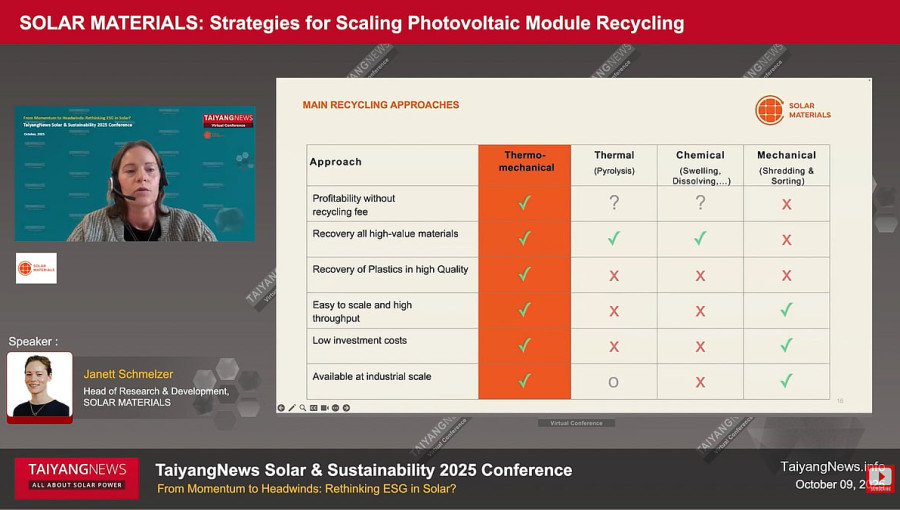

The primary technical hurdle involves extracting these precious materials from the protective EVA layers and backsheets. Current industry methods often struggle to balance profitability with high-value recovery. Solar Materials utilizes a specialized combination of thermal and mechanical processes designed to maximize silver recovery while maintaining economic viability. While newer cell architectures like TOPCon may eventually simplify the purification process, today’s older modules require sophisticated chemical and mechanical treatments to prevent contamination.

Plastics remain the most difficult component to manage. Materials like EVA and various backsheets currently lack a profitable recycling pathway and are generally incinerated for energy. Due to their complex chemical additives and fluorinated compounds, mechanical recycling is both difficult and potentially hazardous. Solar Materials is currently collaborating with research institutions to develop safer, scalable processing routes for these polymers.

Despite these complexities, the company reports a 98% recovery rate for module materials. Aluminum is returned to the metals industry, glass is repurposed for flat glass production, and silver is refined into high-purity fine silver. By 2026, Solar Materials intends to expand its capacity fivefold and launch its first international facility in Italy. This expansion will enable the processing of approximately 350,000 modules per year, establishing a new industrial benchmark for the European PV recycling sector.