Tesla and Sungrow have solidified their status as the most bankable entities in the energy storage sector, according to the latest industry ratings. The report identifies a pivotal shift in the market, where system integrators are increasingly outperforming traditional cell suppliers by sourcing components externally. While China continues to lead global shipments, the industry is seeing rapid expansion in emerging markets like the Middle East and Africa. Overall financial health remains strong, characterized by rising liquidity and significant revenue growth despite evolving regulatory landscapes in the United States.

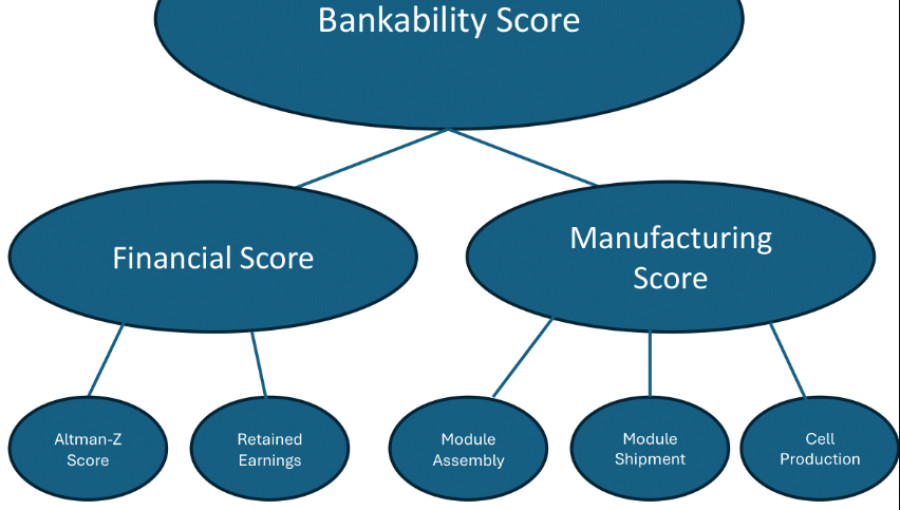

The most recent Battery StorageTech Bankability Ratings Report confirms that Tesla and Sungrow remain the only two companies to achieve a AAA rating. These scores are derived from a comprehensive analysis of manufacturing capacity and financial stability, utilizing a modified Altman-Z analysis to predict corporate health within the specific context of the energy storage industry. The data suggests a widening gap between these leaders and other top-15 competitors, who maintain an average financial score significantly lower than the two frontrunners.

A major trend identified in the quarterly update is the industry’s transition toward a system integrator model. In the initial release of the report, nearly 80% of high-rated companies were involved in solar cell production. However, by the third quarter of 2025, that figure dropped to approximately 50%. This shift reflects a strategic move by many energy storage system (ESS) providers to purchase cells from third-party manufacturers rather than producing them in-house, a strategy that has proven profitable over the past year.

Geographically, China remains the primary destination for battery shipments, accounting for more than half of the global total. However, the landscape is diversifying as large-scale projects emerge in the Middle East, Africa, and Latin America. These regions are expected to capture a larger share of the market by 2026. Meanwhile, the United States has seen a slight decrease in its shipment share. Analysts attribute this to Chinese suppliers redirecting their focus toward other international markets to bypass regulatory hurdles and supply chain disruptions currently affecting the American sector.

Australia is also emerging as a critical developing market, with several sites exceeding 1GWh expected to reach completion soon. This contributes to the growth of the Asia-Pacific region outside of China. Despite the challenges in the US, the global demand for utility-scale developments continues to drive the industry forward.

Financially, the sector is showing signs of maturation. While operating margins have stabilized at around 10%, the revenue generated from energy storage has grown from a marginal fraction to a substantial portion of total earnings for major players over the last six years. Although increased research and development spending for high-capacity solar cell technology has put some pressure on profitability, the overall trajectory for liquidity and leverage remains positive, signaling a robust future for the global utility-scale storage market.