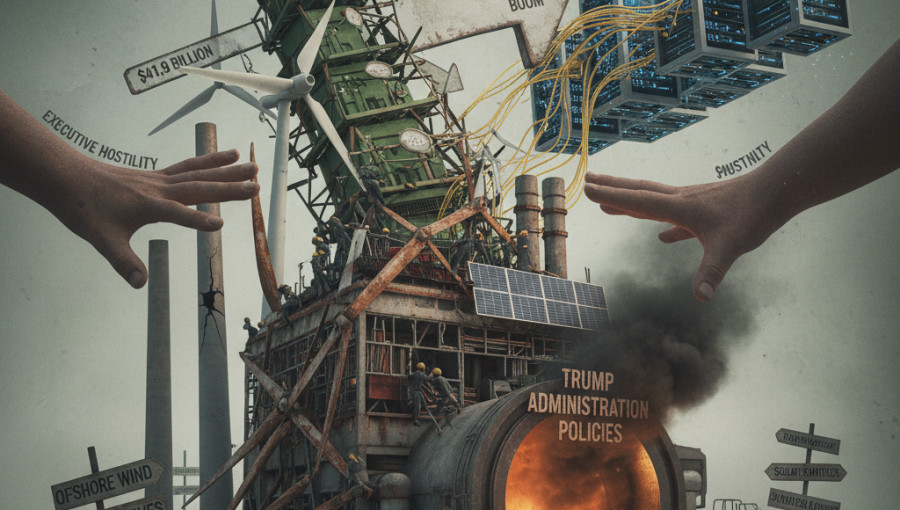

The United States has seen a sharp decline in clean energy manufacturing investment following the first year of the second Trump administration. Data from the Clean Investment Monitor reveals that spending on factories for batteries, electric vehicles, and solar panels fell to $41.9 billion in 2025, a significant drop from the previous year’s $50.3 billion. This downturn marks a stark reversal of the growth triggered by the Inflation Reduction Act, as regulatory shifts and the repeal of key tax credits have led to a wave of project cancellations.

According to a recent report by the Rhodium Group and MIT’s Center for Energy and Environmental Policy Research, the momentum behind American cleantech production has stalled. While the sector previously enjoyed a surge in development, the total value of new project announcements last year—totaling $24.1 billion—was nearly offset by $22.7 billion in scrapped initiatives. This near-parity between new commitments and cancellations signals a growing reluctance among investors to fund large-scale domestic production facilities.

The shift follows several years of rapid expansion fueled by the Inflation Reduction Act (IRA), which provided substantial incentives for both manufacturers and consumers. These policies had successfully directed over $100 billion toward the domestic supply chain, particularly in regions represented by Republican lawmakers. However, recent policy changes under the Trump administration, including the implementation of stricter requirements for factory incentives and the elimination of demand-side tax credits, have undermined the financial viability of many proposed projects.

Beyond direct policy changes, the industry has faced increased hostility toward specific sectors, most notably offshore wind. This political climate has introduced a layer of economic uncertainty that has caused many firms to reconsider their long-term strategies. While some analysts suggest the slowdown could be attributed to market maturation or the massive influx of capital into the data center sector, the data suggests that federal policy shifts are the primary driver of the contraction.

As the industry looks toward the remainder of 2026, experts anticipate further volatility. The loss of momentum in building factories for solar panels and battery storage not only threatens job growth but also risks ceding the global lead in clean energy technology to international competitors. Without a stable regulatory environment, the trend of rising cancellations and diminishing capital investment is expected to persist throughout the year.